Is your strategy set to capture opportunities of an aging population?

We are getting older, and I don’t just mean me and you. The entire population is getting older and demographics of the population is changing. The important question to reflect on is whether your strategy considers this change. Is an aging population threatening your company’s ability to achieve profitable growth? Are you leveraging the opportunities that come with it?

2by2 has done some research with the intention of achieving a more thorough understanding of the degree to which the aging population might have an impact on the corporate world. Specifically, this research has taken a long-term perspective because populations take time to change. However, using a time horizon until 2060 does not mean that change is not necessary today. We are confident that the future will tell that companies that successfully leveraging the aging population to their advantage started to adapt to that change at an early stage.

2by2 has done some research with the intention of achieving a more thorough understanding of the degree to which the aging population might have an impact on the corporate world. Specifically, this research has taken a long-term perspective because populations take time to change. However, using a time horizon until 2060 does not mean that change is not necessary today. We are confident that the future will tell that companies that successfully leveraging the aging population to their advantage started to adapt to that change at an early stage.

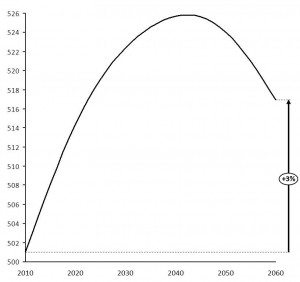

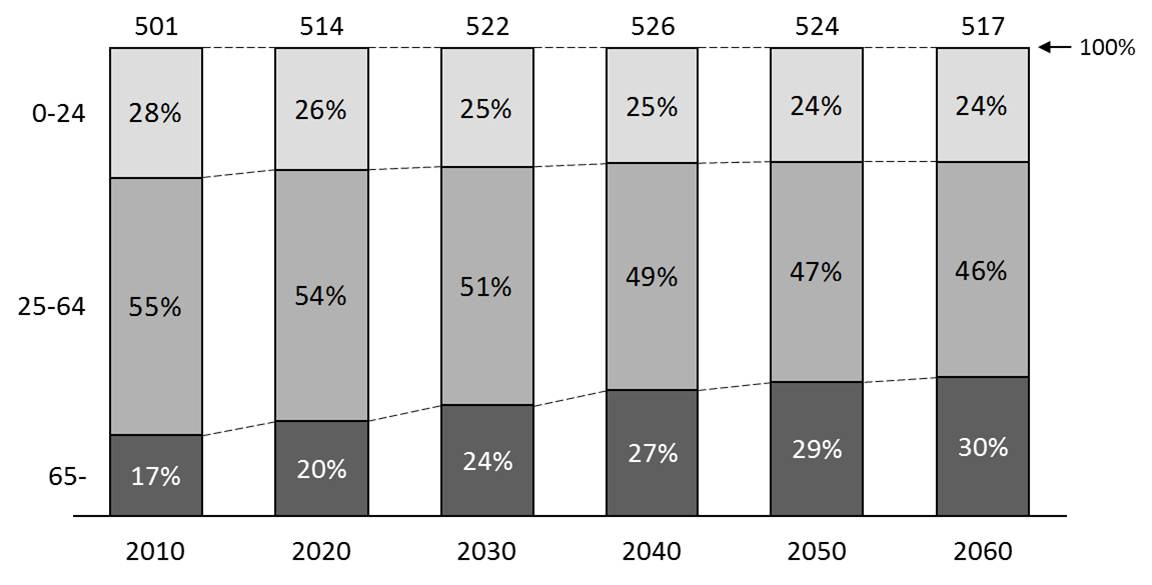

Taking the EU27 (Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxemburg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom) as a basis for the analysis, it is clear that the overall population will grow from 501 million in 2010 to close to 517 million in 2060 (Eurostat); this represents total growth of 3 percent. If we look closer into the evolution of the total population, we notice that what we are actually talking about is a population that will grow to more than 525 million in 2040 and then decline. The analysis behind population projections is based on an assessment of the number of births, the number of deaths, and net immigration.

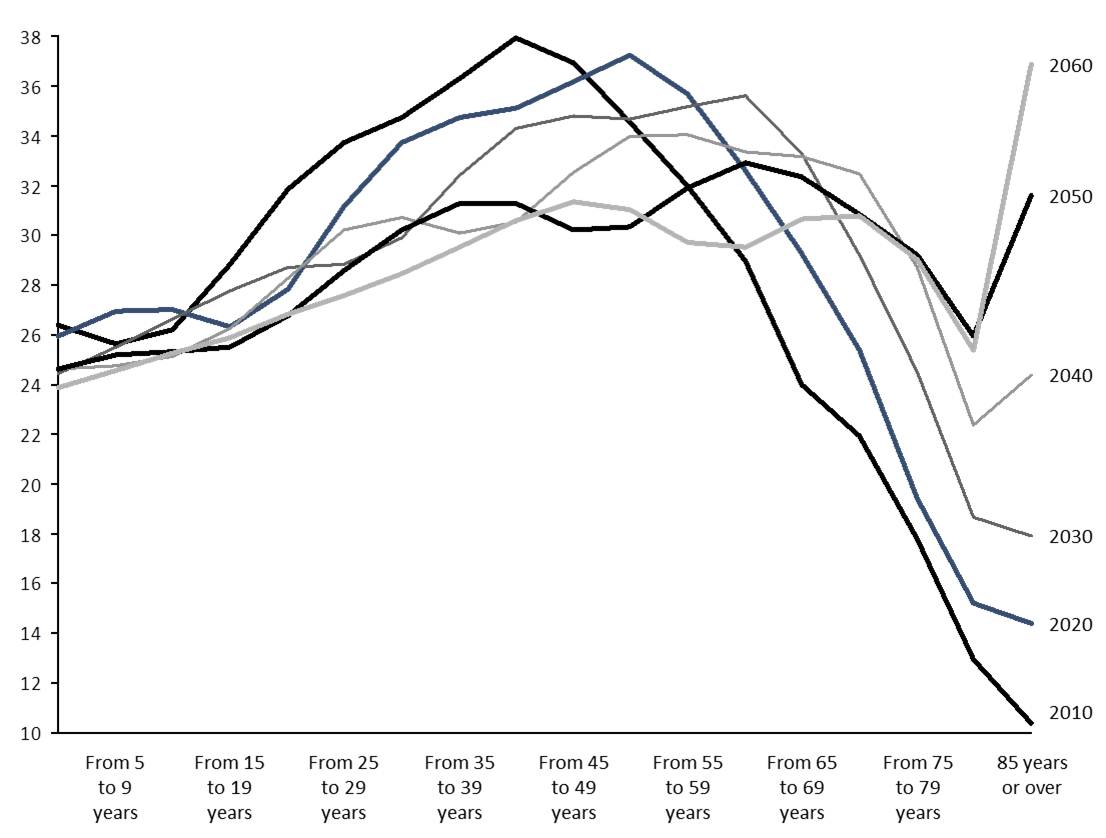

What’s even more interesting is that a closer look at the structure of the population for each year shows a significant shift, whereby a larger and larger share of the total population will be represented by older people as we get closer to 2060. This trend can be observed for the growth period up until 2040 and for the declining period between 2040 and 2060.

Let’s look at what this shift actually means in terms of the structure of the population. Again taking the aggregated EU27 as a basis, 55 percent of the population in 2010 were people aged between 25 and 64, while 17 percent were 65 or over. The changing age structure will have a significant impact on the distribution. By 2060, the share of the population aged 25–64 will have decreased to 46 percent, while over-65s will represent 30 percent of the population. This implies an additional 66 million people being 65 years old or above. Put another way, this number is the same as another France (the 2010 population of which was close to 65 million).

Let’s double-click on a couple of the largest countries in Europe to see how the trend looks specifically for these markets. At the end of the day, many companies address a national market rather than the full European market.

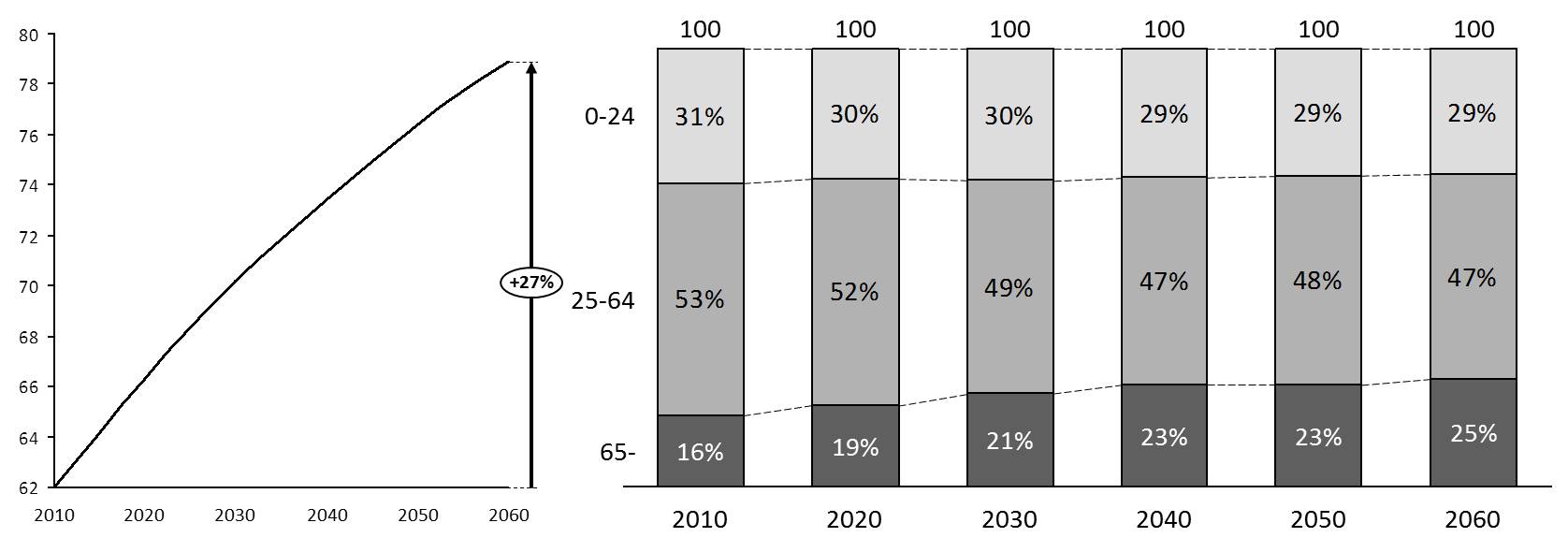

UK

The UK population is expected to grow significantly, from 62 million in 2010 to 79 million in 2060 – a total growth of 27 percent. At the same time as the population is growing, it is clearly aging. In 2010, 16 percent of the population was represented by people 65 or older; by 2060, this share will have grown to 25 percent. This implies an additional 9 million people in the 65+ segment.

France

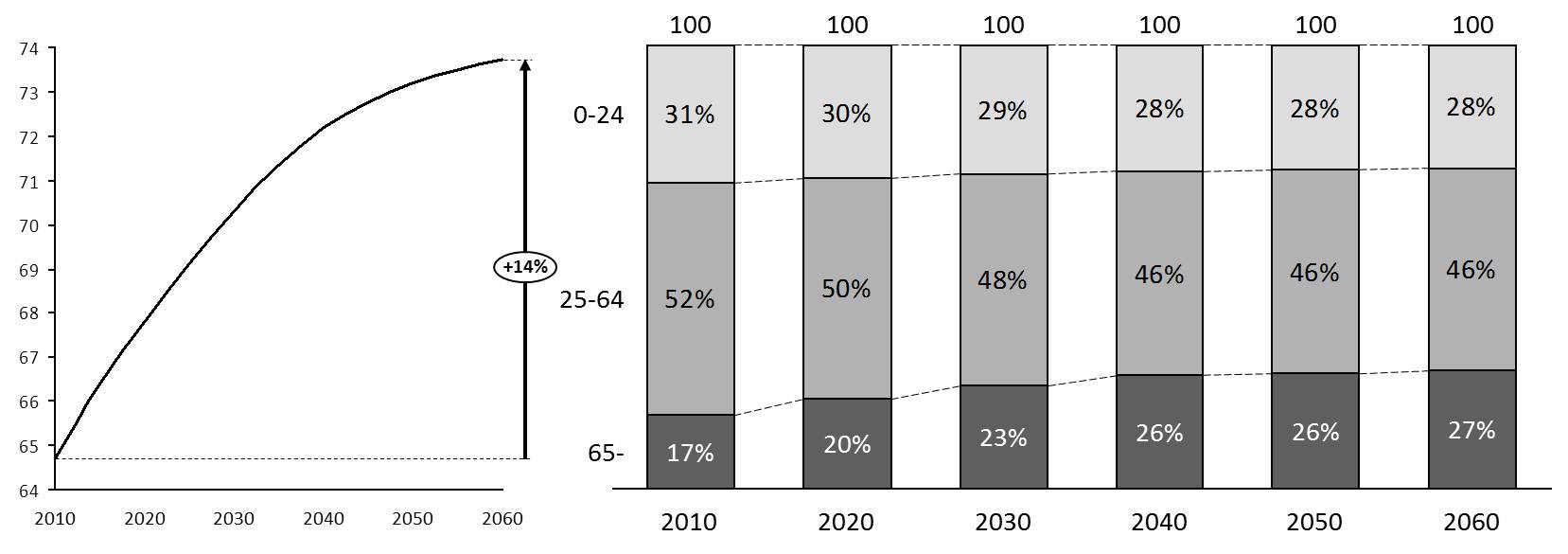

The situation in France is similar to that in the UK. The population is expected to grow by 14 percent, from approximately 65 million in 2010 to close to 74 million in 2060. In 2010, 17 percent of the population was aged 65 or older; by 2060, this share is expected to have grown to 27 percent. This means an additional 9 million people in the 65+ segment.

Germany

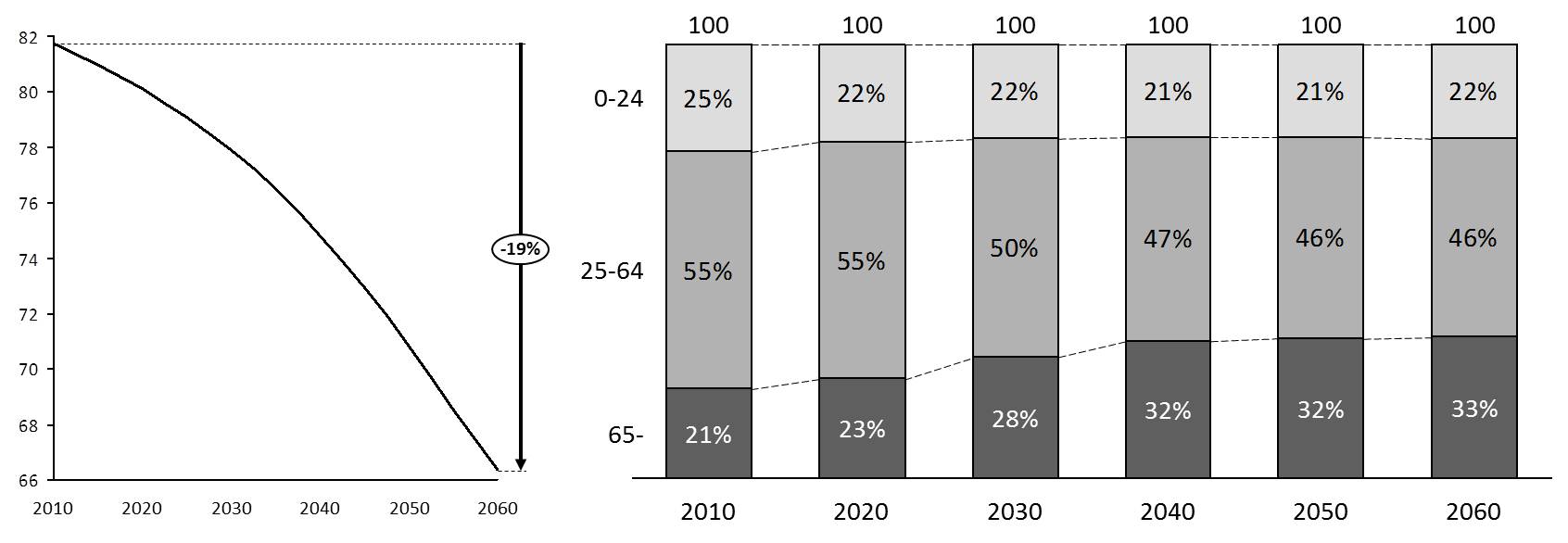

The development of Germany’s overall population is slightly different from that of the UK and France. The population of Germany is actually projected to decline by around 19 percent, from its 2010 level of close to 82 million to 66 million in 2060. Despite the differences in overall development of the population, the same trend regarding the structure of the population can be observed as for UK and France. In 2010, 21 percent of the population is represented by people 65 or older. By 2060, this share is expected to have grown to an incredible 33 percent, which represents an additional 5 million people.

Business implications of an aging population

In order to understand how an aging population might impact businesses, let’s take the clothing market as an example and look specifically at the Swedish market.

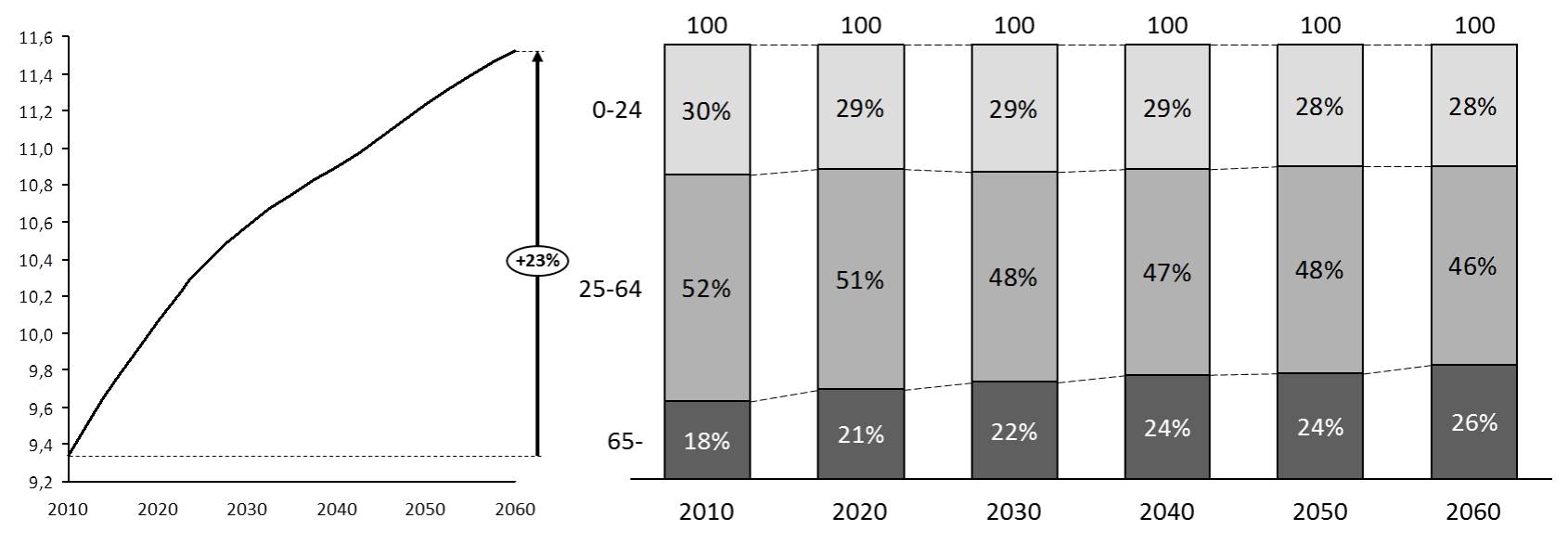

To start with, we can conclude that the population is – like the UK and France – expected to grow. In 2010, Sweden had just over 9 million people. By 2060, the population of Sweden is expected to have exceeded 11 million, a growth of 23 percent. As with the other examples we looked at, the structure of the population will also change in Sweden. Eighteen percent of the Swedish population in 2010 was represented by people aged 65 or above. By 2060, this share will have grown to 26 percent – an additional 2 million people in the 65-plus segment.

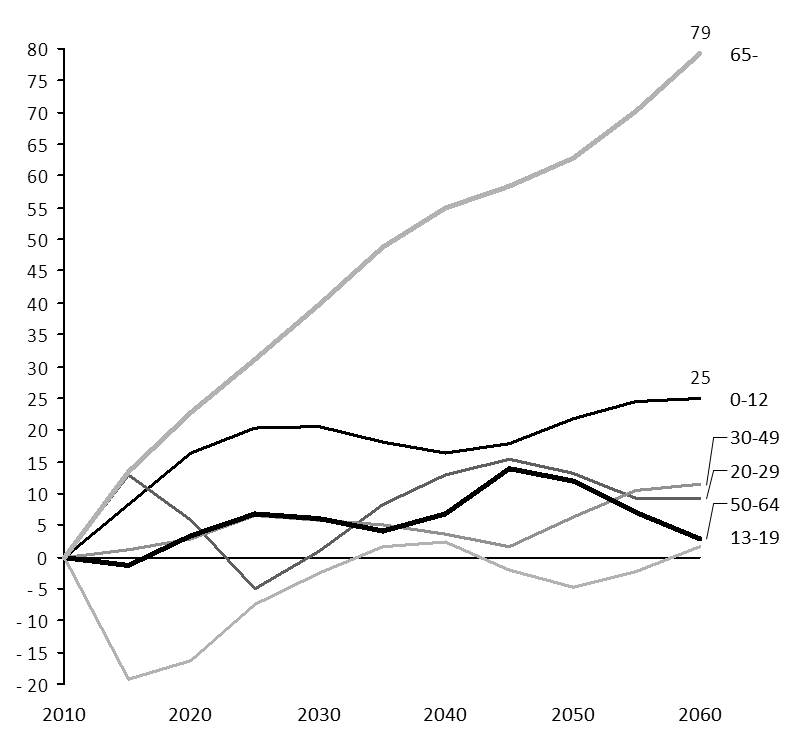

Based on an assessment of purchasing patterns, we can conclude that spending, predictably, varies heavily with age (Statistics Sweden, SCB). People over 65 years of age spend an average of 2971 SEK per person each year on clothes (shoes not included), while people between 20 and 29, for example, spend as much as 5679 SEK per year each. The total Swedish clothing market in 2010 was worth close to 40 billion SEK. Solely through the underlying growth of the population the clothing market in Sweden, this number should reach 47 billion SEK by 2060 (a 19 percent increase), assuming no changes in buying patterns in the population.

The interesting finding is revealed after de-averaging this growth into specific age segments. The Swedish clothing market will grow by an additional 7.5 billion SEK between 2010 and 2060. More than half of that growth is within the 65-plus segment, which corresponds to an additional spend of close to 4 billion SEK. The average spend for the segment covering the population between 0 and 64 years old will grow by approximately 10 percent at the same time as the 65-plus clothing market will grow by an incredible 79 percent.

If you are one of the many companies with a presence in the clothing market, what conclusions can you draw from this? Do you have products that are appealing enough to tap in to the growing 65-plus market? Do you have the right distribution channels to reach these consumers, and do you sincerely know the needs and the preferences of this segment? Or have you simply forgotten to address this growing market in your strategy?

Of course, the aging population will not only have an impact on the clothing market; this was just one simple example. If you are a travel agency, do you understand the preferences of this age group when it comes to traveling? Are they seeking a relaxing vacation or are they actually seeking new experiences? If you are car manufacturer, do you truly understand the specific needs of people aged 65 and above when it comes to cars? Do they prefer performance or are they looking for something affordable? If you run a restaurant, do you understand what preferences this group of people has when it comes to enjoying their dinner? Are they looking for traditional dishes or are they seeking to try out something new? The list could be endless. The key question, of course, whether your strategy is set to capture the opportunities of an aging population.

Hi Jonas at al,

Interesting data! Would be good to know how we expect the spending power to develop for the 65+ consumers, since thóse most probably will retire later, to some extent will have enjoyed a period of economic growth, i.e. their relative spending power may increase?

BR Sigge

Sigge,

Totally agree. This analysis assumes constant spending power and spending patterns in the different segments, which of course is a very conservative assumption. Results would be even more convincing if we we would factor in an increase in purchasing pwer in the +65 segment. In addition one might think of also how possible changes in spending patterns would chnage the market dynamics.

Jonas