In many ways, the Facebook phenomenon is best explained as a movement. The fact that the social network has been able to attract 500 million users since its founding in February 2004 is astounding. Facebook’s ability to connect and reconnect people is unquestionable; its ability to generate sound profits, however, might be worth further examination.

In many ways, the Facebook phenomenon is best explained as a movement. The fact that the social network has been able to attract 500 million users since its founding in February 2004 is astounding. Facebook’s ability to connect and reconnect people is unquestionable; its ability to generate sound profits, however, might be worth further examination.

Because Facebook is not publicly traded, the company’s financials are not fully transparent to external observers. Nonetheless, some figures have circulated around the business community, and 2by2 has looked at these to see what they imply.

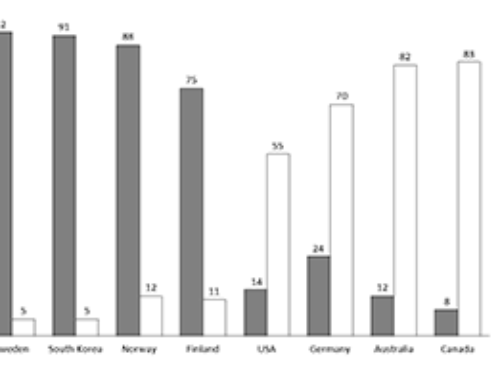

In mid-November, Accel Partners sold off a portion of their shares in Facebook to investors, including Andreessen Horowitz (1). This transaction indicated a total market capitalization of USD35 billion. Sources connected to the company indicated that the revenue for 2009 was around USD800 million and that its profit was in the “tens of millions” (2). Let’s be bullish and assume that it was at the top of that range, USD90 million.

Furthermore, let’s assume that the weighted average cost of capital (WACC) for investment in the internet space is 20 percent, which is probably a fair assumption based on expected returns from investors, given the risk levels. Finally, let’s assume that Facebook is able to continue to grow profits at a rate of 18 percent indefinitely. Such a growth rate implies that Facebook should reach close to 1.5 billion users within another six years, which is more aggressive growth than seen to date.

Facebook’s current financials, with assumptions made on figures such as future growth, etc., would justify a valuation of USD4.5 billion. Of course, this is far from the USD35 billion at which investors currently value the company.

By assessing the profits, it can be concluded that Facebook needs to earn a profit of USD700 million today in order to justify the USD35 billion valuation. In other words, Facebook must be able to earn an average of USD1.40 for every user, compared to the 18 cents per user they are currently averaging, according to our estimates. Facebook valuations look somewhat challenging, to say the least.

Below is a summary of the key figures:

- Market cap: USD35 billion

- Revenue: USD800 million

- Profits: USD90 million

- Profits needed to justify current market cap: USD700 million

- Market cap justified by current profits (18% growth assumed): USD4500 million

- Market cap justified by current profits (0% growth assumed): USD750 million

- Profit per user and per year needed to justify current market cap: USD1.40

- Profit per user and per year with current profit levels: USD0.18

- Techcrunch.com, 2010-11-19, “Accel Sold Big Chunk Of Facebook Stock At $35 Billion Valuation”, http://techcrunch.com/2010/11/19/accel-facebook-chunks-of-stock/

- Reuters.com, 2010-06-18, “Facebook ’09 revenue neared $800 million”, http://www.reuters.com/article/idUSTRE65H01W20100618

And to think the founder was offered 100 bn USD for all shares, and declined.

To understand the business model though one needs to consider both the ad revenue stream (PPV or PPC), and that number of active users are far less, perhaps in the order of 100M users (a number that has also floated around in media).

You can easily assess the number of active users bases on a primarily PPV model (typically 1 USD per 1000 views). Facebook will have to move beyond advertising revenue stream and perhaps charge for games and applications to a larger extent than today. Basically, can they become a “connected AppStore within smart phones” and compete with Apple, Nokia and Android?

Jonatan,

Thank you for your comment. I agree – there are some more aspects of the actual business model that needs to be considered, yet it will probably not make the current valuation less challenging.

Regards,

Jonas