In 2008 Satoshi Nakamoto released the paper “Bitcoin: A Peer-to-Peer Electronic Cash System” which fundamentally became the birth of the cryptocurrency Bitcoin. While nobody still knows who Mr Nakamoto really is, many people quickly became aware of the existence of Bitcoin. The debate surrounding the cryptocurrency has been lively with many supporters and equally many sceptical. While many believe that the underlying technology with blockchain will revolutionize fundamentals around transactions, not just when it comes to money, far from all is convinced that Bitcoin is a given success.

As we closed 2015 we wanted to assess how the Bitcoin was doing from one particular angle, stability. Our belief is that any given currency need to provide some degree of stability in underlying value in order to be broadly adopted. Currencies which doesn’t carry that characteristic will likely be seen as too risky or speculative.

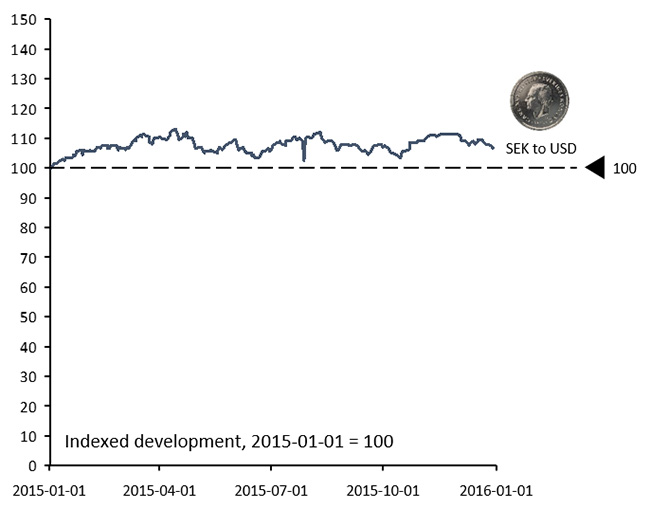

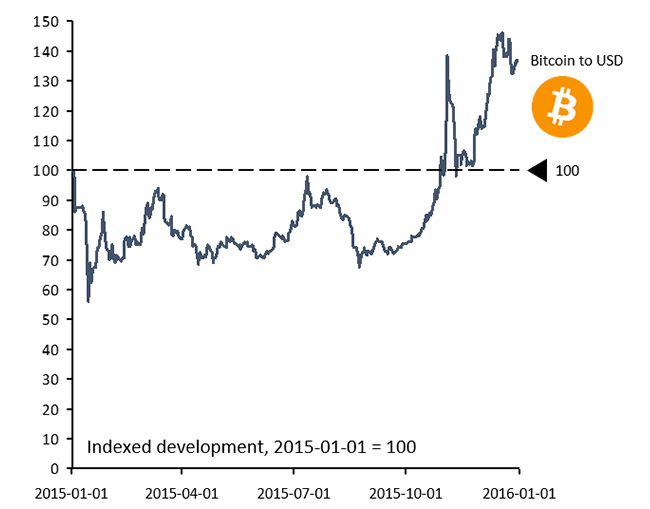

We made a simple comparison by indexing the Bitcoin to USD value, where January 1 2015 was set to 100 and compared that index with a SEK (Swedish Krona) to USD index. The below graphs clearly show the developments of the two currencies.

It is pretty clear from this simple comparison that the Bitcoin was much more volatile in 2015 compared to the Swedish Krona (SEK). The below tables makes the comparison even more clear.

| Category | Swedish Krona | Bitcoin |

|---|---|---|

| Median: | 107,83 | 78,67 |

| Average: | 107,78 | 86,33 |

| Max: | 112,97 | 146,08 |

| Min: | 100,0 | 55,91 |

| Variance: | 6,061589814 | 348,089183 |

| Standard deviation: | 2,462029613 | 18,65714831 |

To summarise the differences, below is a calculation of the standard deviation as percentage (%) of the average price for the different currencies.

We are not saying that the Bitcoin has failed, we believe that is too early to say. However, with the current volatility we believe the Bitcoin is not working as an effective currency and that it will struggle to get much broader adaptation simply because it comes with too much uncertainty and risk.

Source: Deutsche Bundesbank Data Repository, Blockchain

Correct. It’s misleading to name it “cryptocurrency”. Insofaras it cannot be utlised for pricing, lending, deposit, credit, treasury, financing etc it’s not a currency. It’s merely a payment instrument. Back when I was CEO of Money Vector in Asia, we made use of earlier technologies such as DigiCash. The central banks of Singapore and Malaysia were quite interested, but unfortunately DigiCash wasn’t operated very well. Yet some European and US banks did take on DigiCash and made it stable by actual treasury backing. As the current situation is, this could quite possibly be done with blockchain based digital currencies as well, and there are a few good contenders for this.

Blockchain is a revolutionary tech and this is vital part of our future global digital economy powered by web 4.0 + AI + Blockchain & Crypto. That’s why this tech will keep developing and evolving, we already have interoperable blockchains able to communicate and transmit transactions, instead of legacy isolated blockchains of the past… The adoption rate is faster than the internet adoption of the 1990s. This tech can provide banking, fin tech and other services and much more at the fraction of a price. This is truly revolutionary!